Most of us have heard about insurance, and we understand that we need it, but we do not really know how. The limit is one of the most crucial components of your policy: the amount your insurance is required to pay in case you are involved in a claim. The ignorance of this may result in you being underinsured or in unforeseen expenses. In this article, we shall dissect the knowledge of policy boundaries and the importance of such knowledge to your insurance cover.

Insurance policies are limited, and this implies that the insurance company has a limit beyond which it will not pay any claim. Awareness of these limits will assist you in ensuring that you have the correct coverage. Otherwise, you can be fooled into believing that you are totally covered when, in fact, you are not adequately covered.

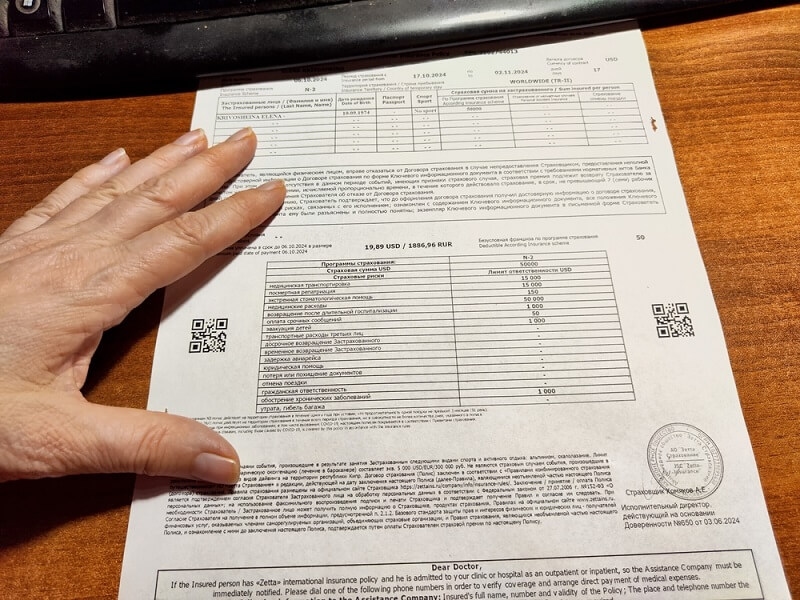

The highest possible sums that your insurance company will cover on covered losses are the policy limits. This may be property damage, medical expenses, or liability expenses. Limits are typically varied based on the type of insurance that you are insured with.

There are those policies that have different limits per incident but have an overall limit within the policy term. These limits are very important to know so that you are not charged out of pocket when your claim has surpassed the maximum amount paid.

The importance of limits is that they directly affect the degree of financial protection that you are, in fact, enjoying. Suppose there is a severe accident or damage to property, and the costs to repair are even more expensive than your policy limit. In the absence of the right understanding, you can find yourself having huge bills even when you thought your bills were covered.

The knowledge of policy boundaries will prevent such shocks. It also allows you to modify your cover before an occurrence of a problem, and that gives you the confidence that you are well covered.

The maximum points that your insurance policy is going to pay is referred to as coverage ceilings. They establish a limit on your financial security.

Coverage ceilings vary by insurance type. In health insurance, it might be the maximum your policy pays for a certain treatment. In auto or home insurance, it may be the total amount for repairs or liability claims.

Knowing these ceilings helps you plan better and decide whether you need additional coverage.

When a claim comes in, the insurer checks if the costs are within the coverage ceiling. If they are above it, you pay the difference. This is why understanding coverage ceilings is crucial—it prevents unpleasant surprises during stressful times.

For example, if your coverage ceiling for home damage is $100,000 but repairs cost $120,000, you will have to cover the $20,000 shortfall.

Maximum payout is the absolute most your insurance will pay for a claim. It’s often mentioned in the policy as the limit of liability or benefit.

While maximum payout is similar to a policy limit, it specifically refers to the final payment for a claim. Coverage limits may have multiple types, like per occurrence and aggregate, which can affect the actual payout you receive. Knowing the maximum payout helps you avoid financial risk.

Maximum payout matters in situations with high expenses. For example, medical bills, legal settlements, or large property damage can quickly exceed average policy limits. If you are unaware of the maximum payout, you may assume insurance will cover everything, leading to unexpected stress.

Limits can directly influence your ability to get full compensation in an insurance claim. If you are not careful, you might discover your insurance doesn’t cover as much as you thought.

Insurance policies often include per-occurrence vs aggregate limits. Per occurrence is the maximum payout for a single incident. Aggregate limit is the total amount the insurer will pay over the entire policy period, usually a year.

For example, your home insurance may have a $50,000 per occurrence limit but a $100,000 aggregate limit. Two separate claims of $50,000 each would max out your coverage for the year, leaving you unprotected afterwards.

Sometimes claims are partially denied or not covered at all because they exceed policy limits. This is why it’s important to understand your limits before filing a claim.

If your current policy limits are too low, there are ways to increase them. Doing this ensures better protection without changing your insurance entirely.

You can often increase your limits by contacting your insurer and requesting a higher payout. This may slightly increase your premium, but it can prevent major financial risks in the future.

The higher limits can be quite useful, especially when your property or assets have appreciated or when your lifestyle changes and you become more liable.

An increase in the limit is not only necessary, but it is usually required following significant changes in life. Your insurance requirements may increase by purchasing a new house, growing your business or the birth of a child.

Proactively changing limits ensures that your insurance is available when required most.

A better way of appreciating the limits of the policies is to examine real-life scenarios where limits matter a lot.

You have an accident in your car that causes you damages of up to $80,000, but your policy limit is $50,000. The rest of the payment will be out-of-pocket, which will be $30,000.

This shock to the pocket may be avoided by understanding your limit beforehand. A limit of higher choice or umbrella might help you to save thousands of dollars in case of an emergency.

Suppose a house burns down, and it will require you to pay 200,000 dollars to have it repaired, and your house insurance has a $150,000 limit. The additional $50,000 would be in your hands.

Knowing the policy limits and maximum payout meaning, the homeowners will be in a position to make wise decisions and not be underinsured.

Per occurrence limits are important with regard to personal liability. In case an individual sues you and the settlement is above your limit, you may lose your personal assets. Being aware of the distinction between per occurrence and aggregate limit will make you spot when you need more liability coverage.

Knowing policy limits is not as simple as reading the numbers in your insurance policy. It is concerning financial security, peace of mind and protection in the event of unforeseen events. When you are aware of your per occurrence vs aggregate limits, coverage ceilings and maximum payout meaning you will be able to make smarter choices about your claims and limit increase choices. This information will make sure that you are not taken by surprise and that your insurance can actually stand by you in the time you really need it.

This content was created by AI