One car detail that is often overlooked until you need it the most involves your auto insurance policy number. The policy number is not just an arbitrary mixture of digits but rather your unique identifier for everything related to your insurance coverage. Whether you need to file a claim, call customer service, or look up an auto insurance policy number, you'll need to know where to find this information and how to read it.

In this detailed guide, we'll break down how to read an auto insurance policy, how to locate your auto insurance policy number, understand your auto insurance policy limits, and how to make sense of the details printed on your insurance card or documents.

Your car insurance policy number is a special code your insurer uses to identify your particular policy. Consider it as your fingerprint in the world of insurance, because it differentiates your coverage from every other customer the company covers.

In general, your car insurance policy number should be on your insurance card, your billing statement, or any document from your insurance company. The number is handy when you're:

Most of the auto insurance policy numbers consist of 8 to 13 characters, including letters and numbers. The format may vary, though; every insurance company has a different way of setting it up. For example, State Farm uses 10 digits, but GEICO and Progressive have mixtures of letters and numbers.

If you are not certain where to find your auto insurance policy number, here are some reliable places to check:

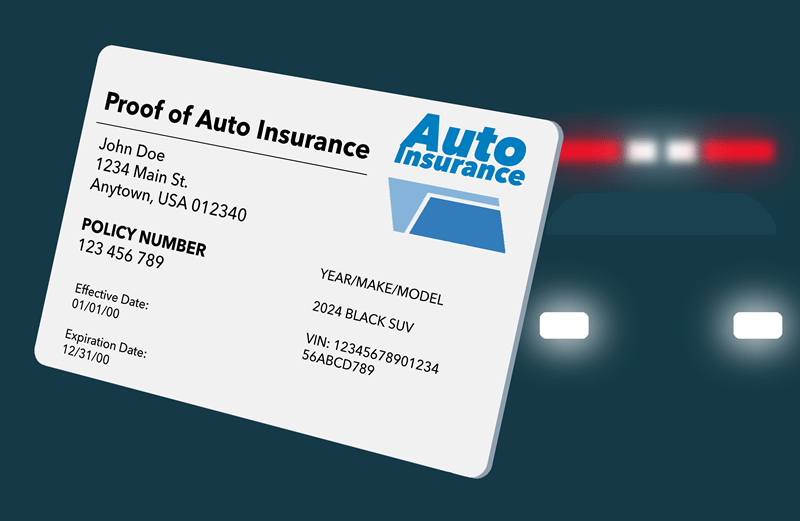

Your auto insurance policy number is on your insurance card. You can usually find the car insurance policy number in the upper or central part of the card, which may be titled "Policy ID" or "Policy Number."

When you buy a policy or renew your policy, your insurance company will provide you with detailed policy documents, typically specifying your policy period, policy limits, coverage limits, policy number, and more.

Most large insurance companies will provide you with an account you can log in to online or through an app. It allows you to access your auto insurance policy number at any time.

This is the easiest step to take for an auto insurance policy lookup if you lost your card and need to find it.

Suppose you have received a paper or electronic bill from your insurance company. In that case, your policy number is usually located at the top of the billing statement, traditionally listed within the account summary portion.

One of the easiest ways to find your car insurance policy number is to call your insurance company directly.

A representative of the insurance company will verify your information and then provide you with your car insurance policy number at that moment.

Reading your car insurance policy can be overwhelming, but it becomes much easier after familiarizing yourself with the key elements of a car insurance policy. Here's a simple breakdown:

This is the first page of your policy, and is commonly called the "Dec Page." This page provides:

This page acts as your policy's summary of coverage and quick reference page.

Each section describes the type of protection you have and how it applies.

Common car insurance coverage categories includes:

Understanding these will help you make better decisions when comparing auto insurance policy limits.

Every policy has exclusions of what is not covered. This will explain those things that your insurance company will not pay for, such as deliberate damage or using your vehicle for business, if this has not been specified.

Endorsements are add-ons that modify your base policy. These may include items like roadside assistance, rental reimbursement, or gap insurance. Always read these very carefully as you go through your auto insurance policy documents.

Your auto insurance policy number is the key to all of your insurance-related activities. Here's why it is so important:

Without this number, claims processing or document access becomes far more cumbersome.

Sometimes, drivers misplace their insurance cards or can't remember which company issued their policy, especially if they've recently changed providers. That is when an auto insurance policy number lookup becomes necessary.

Here are four methods to help you find your auto insurance policy number.

The easiest way to find your auto policy number is to call your insurance company's customer service line. After providing your name and other information about your vehicle to confirm your identity, a representative will be able to find your auto insurance policy number.

If you have signed up for online access, checking your auto insurance policy number can be done quickly and easily. Click on view policy details, and you will see your auto insurance policy number and policy limits.

In many states, drivers can check insurance information through their state DMV to confirm the insurance status of a vehicle. If an auto insurance policy is discovered and linked to your car, your auto insurance policy number should also be displayed.

If you automatically pay your premium, your bank records should include payment references that include the name of the insurance company and your auto insurance policy number.

The limits on your auto insurance policy define the maximum amount that your insurer will pay for a covered claim. These limits are necessary because they determine how much you are responsible for paying out in the event of an accident.

Just as an example, a limit of "100/300/100" means:

Higher limits for auto insurance provide more protection; however, it may increase your premium. Knowing your limits will help you strike a balance between affordability and coverage.

For this reason, you should review documents associated with your auto insurance policy number to ensure that the limits stated reflect your desired coverage.

We all know that in life, things change. If you bought a new car or moved to another state, for instance, you will want to update your policy. If you need to change your policy, here’s how you can do it with clarity and not ambiguity.

Please use your auto insurance policy number to request your file or make changes.

You may need new auto insurance policy limits or additional coverage.

After updates, ensure that your auto insurance policy number is still active and valid under your revised policy.

Always have a copy of your updated insurance card and store digital copies in your email or phone for easy access.

Even experienced drivers can overlook crucial details in their policy. Avoid these pitfalls:

Please check your policy whenever you get an update or renewal.

While your auto insurance policy number may seem like minutiae, it actually plays an essential role in the effective management of your coverage. Whether you're checking auto insurance policy limits, conducting an auto insurance policy lookup, or learning to read an auto insurance policy, knowing this number will facilitate smooth communication with your insurer and expedite claims processing.

It's a good idea to have your auto insurance policy number on you at all times: in your wallet, phone, and glove compartment. That way, you are always prepared whenever life on the road changes unexpectedly.

This content was created by AI